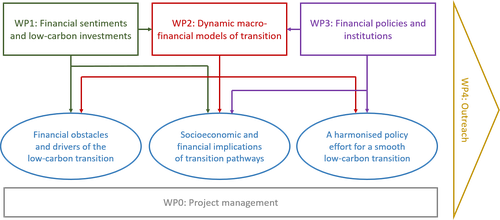

The aim of SMOOTH has been to study the dynamic links between macro-financial systems and the transition to a low-carbon society, and to contribute to the design of policies directed at achieving a rapid and smooth decarbonisation.

The project was composed of three main areas of work:

- The study of how heterogeneous expectations, sentiments and cognitive biases affect the carbon intensity of physical and financial investments.

- The analysis of the macroeconomic/financial drivers and implications of the low-carbon transitions.

- The study of the governance and political economy implications of a low-carbon transition, with a focus on the role of central banks and financial regulators.

SMOOTH started in September 2020 and ended in August 2025. It has been conducted by an international interdisciplinary research team at the Department of Economics of the University of Bologna, in collaboration with the RFF-CMCC European Institute on Economics and the Environment, based in Milano.

Ongoing activities have included:

- The development of a dynamic modelling framework with heterogeneous transition-related expectations.

- The analysis of how transition-related shocks propagate via international production networks.

- The study of the impact of financing constraints on clean technical change and the policies to support it.

- The development of an analytical integrated assessment model to study optimal transition paths.

- The expansion of socio-technical transition theory to include the financial regime, with a focus on central banks.

- The analysis of climate-related central bank communication.

Contacts: emanuele.campiglio@unibo.it; emanuele.campiglio@eiee.org