The GrEnFIn EMJM is a multidisciplinary programme that provides students with a culturally diverse and academically rigorous education.

Its purpose is to equip students with the skills needed to analyze and address challenges associated with the transition to a low-carbon economy.

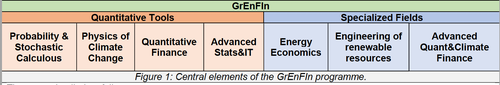

The GrEnFIn proposal is centred around a common quantitative background and three specialized fields, representing its core elements.

GrEnFIn Quantitative Tools :

- Probability & Stochastic Calculous

- Physics of Climate Change

- Quantitative Finance

- Advanced Stats&IT

Specialized Fields :

- Energy Economics

- Engineering of renewable resources

- Advanced Quant&Climate Finance

Basic and Advanced Quantitative Tools for Climate Science and Finance.

This subject within the GrEnFIn programme provides crucial highly training in quantitative analysis with applied connotations. It focuses on the interdisciplinary nature of financial sciences in sustainability, emphasizing innovative tools and methodologies, as well as teaching mathematical-probabilistic formulation of financial models and the impact of pivotal variables on the sustainable transition and induced uncertainty. This common background also includes the analysis and interpretation of data using statistical-AI methods and machine learning to implement scenarios’ analysis able to provide a deeper understanding of climate science, prediction, and mitigation strategies.

Energy Economics.

This specialized area delves into technical aspects of transition dynamics and socio-economic impacts. It encompasses climate-related macro-financial risks, climate economic modeling, mitigation policies, interactions between commodities (coal, oil, gas, electricity), emission permits market, and climate policy, all viewed from an economic perspective concerning the green transition.

Engineering of Renewable Resources.

Focused on sustainable engineering technologies, this specialized area covers solar and wind energy, marine renewable energy, bioenergy, hydrogen, and heat recovery and storage systems. It enhances students' knowledge in Renewable Energy and Climate, providing a comprehensive understanding of the energy market and the implications of the transition process in terms of increased risk.

Advanced Quant&Climate Finance.

This specialization proposes advanced models of quantitative finance to analyze the theory of derivatives written on variables related to climate or other natural variables. The aim is to identify risk hedging solutions involved in the energy transition. All the potentialities of the green asset class are investigated in terms of performance and risk diversification, aspiring to achieve optimal portfolio selection and management.