Report 23/06/2020

Curves are still rising in both sectors

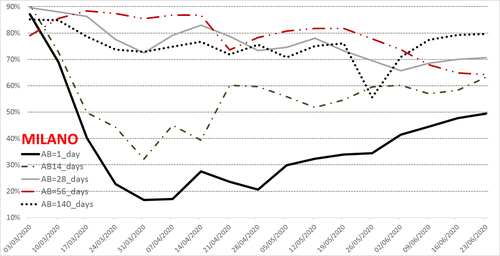

Milan: Seasonality plays a role, but expectations keeps increasing

Curves are still rising in Milan, where the Hotel Activity Index in the very short-term (AB1_day) peaks to about 50%, the maximum in the Covid-19 period. The same trend is shared by hotels offering rooms in July (AB14_days and AB28_days), where the indices swing between 60% and 70%. The HAI curve for August (AB56_days) is on a different trend, being downward sloping, but this is likely the effect of seasonality.

Seasonality also explains the gap between HAI in the long term (AB140_days) and HAI in the very short term (AB1_day). The 30 percentage points gap reflects the different opportunity-cost of offering rooms in Autumn (the high season for the business segment) and in Summer (low season for Milan), which also partially discounts the uncertainty linked to the post-lockdown phase.

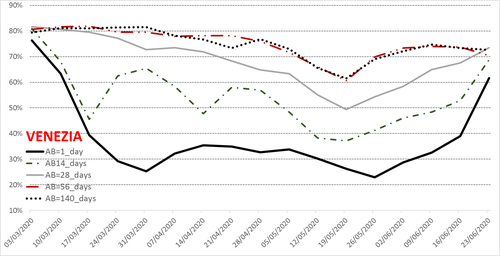

Venice: Summer is there and brings “normality”

Hotels of Venice show a positive trend, that accelerates in the short term. The HAI curves at 1 and 14 days jump up, almost eliminating the gap with the other curves, while the share of hotels offering rooms at the end of July (AB_28 days) overtakes the the longer term curves.

This fact signals the great confidence of the Venice Hotel sector. The reopening of borders and the return of “normal conditions” is expected to sustain tourism flows in a way that they are sufficient to cover operational costs. However, the uncertainty about the evolution and the management of the pandemic in the next few months is not over yet: on the one hand, long-term curves are stable; on the other hand, all curves are below 80%, signalling that more than one fifth of the Venetian Hotel sector is not present yet online.