Report 09/06/2020

The trend is generally positive. Net of seasonality effects for business market and the lifting of travel restrictions in the Schengen area for leisure.

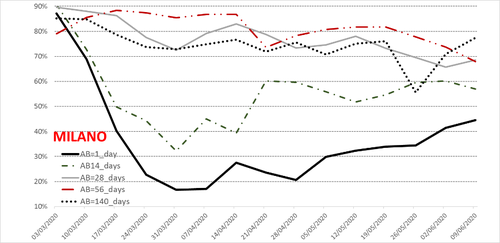

Milan: the market is recovering, net of seasonality effects.

The trend is generally positive in Milan, where the very short-term Index of Hotel Activity (AB1_day) is in steady recovery since the end of April. The index at two months (AB56_days) is decreasing, but this is likely due to a seasonal effect stemming from lack of business tourism in August. On the contrary, the index at 140 days (AB140_days) is strongly rising, being now close to 80% and recording an increase of 22 percentage points in two weeks. This is a very positive signal, as it refers to the period of October/November, when most of the MICE activity cancelled in Spring has been rescheduled. However, there are about 25% of hotels still missing on the market, a figure that reflects, more than negative expectations on demand recovery, uncertainty on the profitability of online reservations with respect to direct bookings with customers.

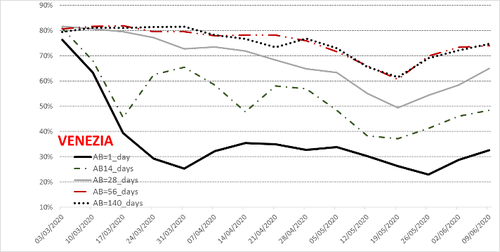

Venice: waiting for June 15.

The positive mini trend in Hotel Activity, started on May 19 (May 26 for AB1_day) reflects increasing expectations on the lifting of travel restrictions in the Schengen area, scheduled for June 15. The question mark is related to the behaviour of European tourists in the first days of travel mobility, as reservations have been missing in the three months of emergency. This uncertainty is reflected in the gap between short- and medium-term expectations: still, only less than 50% of hotels offer availability for June 23 (AB14_days) while the HAI index rises to 75% from August (AB56_days).

We notice that the share of hotels offering availability online is lower in Venice than in Milan. This is not surprising, given that the lockdown has more important effects for the leisure rather than for the business segment. The gradual reopening of borders should eliminate this gap.