Report 30/06/2020

Towards stability for the summer season in the business sector, still uncertainty in part of the leisure one

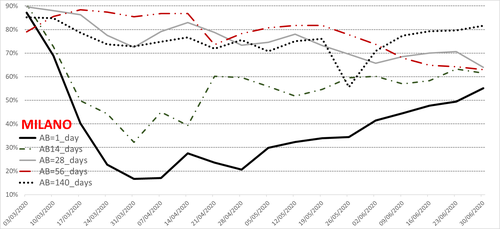

Milan: towards stability for the summer season.

The index’ movements of last week show that hotels are eventually deciding their strategies as regards summer months. The Hotel Activity Index (HAI) at very short-term grows of other five percentage points since last week (reaching 55%, AB1_day), while HAIs at 14, 28 and 56 days slightly decrease, converging to 60%, towards which also the AB1_day index will converge. It is then clear that about 40% of Milan hotels have decided not to reopen for the summer. We also notice that half of those (about 20% of the total) are not even accepting reservations at five months (AB140_days): this can be interpreted as a signal of wait, stemming from the high uncertainty associated with the evolution of the pandemic, or a signal of strong difficulties to stay on the market.

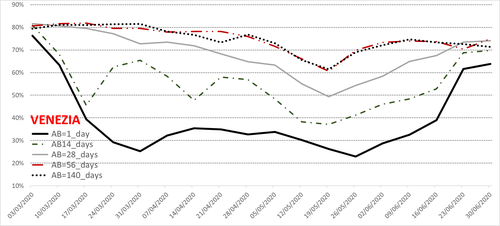

Venice: one out of four hotels does not make it.

The movement of the Hotel Activity Indices towards convergence (in this case, around 70-75%) is also obvious for Venice. The very short-term HAI (AB1_day) keeps growing, and reaches 65%, while the other HAI are all lining up between 70 and 75%. This means that around 25% of Venice hotels (one out of four) is yet not active on the reservation market, neither in the summer months (when a partial return of foreign tourists is expected), nor in the Autumn season. In the case of Venice, we can identify two partially alternative explanations: according to the first one, hotels have decided to delay their return on the market as they wait for more positive signals of demand recovery (for example, there is still great uncertainty on foreign demand recovery, due to contrasting decisions on travel mobility from extra-EU countries) and on the evolution of the pandemic; according to the second explanation, hotels would show solvency issues, that could compromise the continuation of their activity.